Whether you’re already offering ADAS calibration services or considering adding it to your business, Section 179 of the IRS tax code can be a game-changer by making investments in ADAS equipment more affordable.

What is Section 179?

Section 179 of the IRS tax code is like a fast track for saving on business expenses. Instead of gradually deducting the cost of new tools and equipment over a number of years, it lets you write off the full purchase price in the same tax year you buy or finance them. This means you get immediate tax savings, which can free up cash to reinvest in your business sooner rather than later.

For owners of collision, auto repair, glass shops, this deduction can be a huge help, reducing the initial cost of things like diagnostic equipment, ADAS calibration equiment, and even software updates. It’s a great way for smaller shops to stay competitive, letting you bring in the latest tech without a big financial hit. So, whether you’re upgrading your ADAS systems, adding a new diagnostic tablet, or refreshing your shop with new software, Section 179 is designed to make those investments easier.

For 2024, the maximum deduction under Section 179 is $1.22 million. If you want to deduct the cost of equipment from your 2024 taxes using Section 179, the equipment must be acquired and put into use by December 31, 2024.

What Can I Purchase?

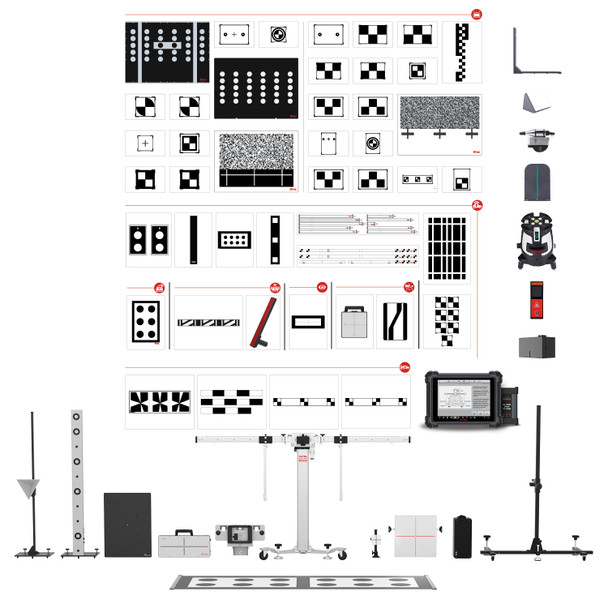

Here’s the best part – anything at adasdepot.com qualifies for this tax deduction, so long as it’s used for business purposes. For example, you might be interested in a full mobile calibration setup:

It’s important to maintain records of how you use the equipment in case you need to prove that this equipment is used for business purposes. In the case of the MA600 All Systems + Tablet combo, an easy way to prove this would be to pull up all the previous calibrations you’ve performed. Simple as that!

Other examples of things you can purchase:

- Diagnostic tablets (e.g. Autel MSULTRAEV, MS909)

Can software qualify for the Section 179 Deduction?

Yes, it can. Off-the-shelf software can qualify under Section 179 deduction.

Total Care Program (TCP) Card: updates vehicle coverage and extends warranty for an extra year

Can I lease or finance equipment and still take a Section 179 Deduction?

Yes, equipment acquired through capital leasing or a non-tax capital lease can qualify for the Section 179 deduction. This makes it an attractive option for businesses that want to procure equipment without significant upfront costs.

Financing can often lead to a scenario where the tax savings from the deduction will exceed the payments, making it a profitable decision for the tax year. However, it’s always best to consult with a tax professional or financial advisor to understand how Section 179 Qualified Financing can work best for your specific business situation. You are reading that correctly; in many cases, the tax savings from the deduction will make your bank account larger than if you never financed the equipment in the first place.

An example to illustrate this scenario:

Imagine you decide to finance a piece of equipment for $50,000 with a bank loan. This equipment qualifies for a Section 179 deduction, which allows you to deduct the full cost of the equipment in the first year.

Let’s assume the following:

- Loan term: 5 years

- Annual payment: $10,000

- Your tax rate: 30%

With Section 179 Deduction:

- Full Deduction of Equipment Cost: You deduct the entire $50,000 equipment cost in the first year.

- Tax Savings: At a 30% tax rate, this deduction saves you 30% of $50,000 = $15,000 in taxes.

- Impact on Bank Account in the First Year:

- You make a $10,000 payment.

- You get $15,000 in tax savings.

- Net effect: Your bank account actually grows by $5,000 in the first year.

Over 5 years: Your total out-of-pocket payments remain $50,000, but you’ve received $15,000 in tax savings upfront, resulting in a net effect of only $35,000 spent over the five years.

Key Point: By financing, you spread out the equipment payments, while the Section 179 deduction gives you a large, upfront tax break. In this case, the tax savings make your bank account larger in the first year than if you hadn’t financed the equipment.

ADAS Depot offers financing if you are interested. Go here to learn more.

Can I claim the Section 179 deduction for used equipment?

Absolutely. Section 179 deduction is applicable to both new and pre-owned equipment. The stipulation for qualifying is that the equipment should be procured and set in use during the same tax year the deduction is filed for.

Resources

https://www.section179.org is the official website of Section 179 and is a fantastic resource for learning more about it.

The Section 179 Calculator is worth exploring. Simply enter the cost of the ADAS equipment or software you’re considering, and see the estimated savings.

Sign the petition! Small and Medium businesses are the lifeblood of the U.S. Economy. You can let Congress know that allowing businesses to invest in equipment is good for the overall economy.

Conclusion

With the help of Section 179, automotive business owners can make strategic investments in ADAS calibration systems and software upgrades with a reduced tax burden, boosting both profitability and service capabilities. It’s a great opportunity to get into ADAS if you take advantage of the synergies of equipment financing and Section 179.

Leave a Reply